Lerner students provide free tax help

April 08, 2025

Students give back to community while acquiring valuable tax knowledge

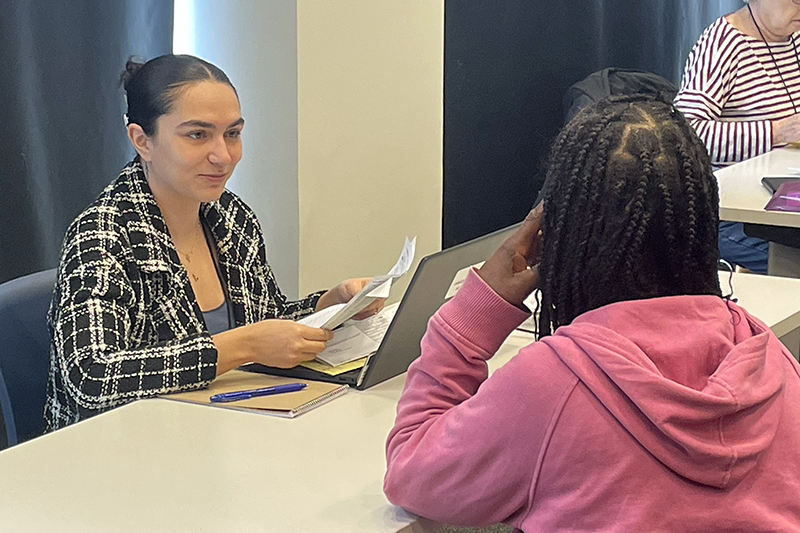

For University of Delaware senior Victoria Groome, volunteering with the Volunteer Income Tax Assistance (VITA) program provided a meaningful opportunity to help underserved populations near her hometown.

Groome, a Claymont, Delaware, native and criminal justice major with a concentration in law and society and a minor in legal studies, is learning new ways to implement policies that give more resources to disadvantaged communities.

But the program has given her so much more — namely, forging relationships with the people she meets as she helps them file their taxes.

“I have clients get so excited when I tell them I’m a UD student, and they want to give me advice and tell me their stories,” she said. “I love when people tell me about their kids. So it’s nice when families come in and they have children in high school, and (I can) give them some advice.”

Groome is one of 42 UD students volunteering with the VITA program this year, providing a service that provides free tax preparation for those making up to $67,000 in household income. It’s a partnership between UD’s Alfred Lerner College of Business and Economics and local nonprofit Nehemiah Gateway Community Development Corporation, which aims to improve the financial well-being of people with low to moderate incomes through various services.

The IRS contracts with community partners in local states and areas, and Nehemiah Gateway is the only IRS grant recipient in Delaware. The corporation runs 10 physical in-person tax sites serving the state’s three counties, including Woodlawn Library in Wilmington, where Groome volunteers.

Instructor of accounting Karen McDougal, who oversees the program and administers a training course that the students must pass to become certified, emphasizes the importance of UD students’ participation.

“It means everything,” she said. “Our students are going out in the community and providing an essential need, which is helping all citizens complete their civil responsibility of voluntarily and timely filing their tax returns, and taking advantage of government programs that are affording them the opportunity of securing additional refund dollars.”

McDougal also stressed that the UD students seem to get much more out of the program than just tax expertise.

“The students learn so much. They write a reflection paper at the end of the course, and in it I just swell up with tears when I think about how they reflect on the individuals they’ve met and served, and more importantly, the individuals they’ve helped,” McDougal said. “These are individuals they probably never would have come in contact with, but they developed such a sense of value and appreciation for not only their situations, but the importance of everybody doing something to help others.”

Stacey Hunter Withers, tax campaign director at Nehemiah Gateway, is grateful for the students’ assistance.

“That’s the best part of the program; the value the students bring is second to none,” she said. “Most of them come in without any tax experience, and they leave here with a valuable skill. They learn so much not only about how to prepare taxes, in the event they’d ever have to do them themselves, but they get an intrinsic value out of helping the community.”

For UD junior Abrar Hossain, an economics major with a leadership minor who had no prior tax experience prior to entering the program, the idea of giving back was also a factor in his interest.

“I enjoy it because it’s giving back to the community, and also just helping the clients that come in,” he said. “They share stories with me, so I get to know them and they get to know me. It’s a wonderful experience. The people who work here are experienced, and they’re just very down to earth.”

Quinn Higinbothom, a senior international business major, echoed those sentiments.

“The sessions are three hours but feel like 30 minutes,” she said. “The people I have met have made this entire experience for me. I gained knowledge of taxes that I would not have had prior, and for that I am so grateful. I have loved hearing the stories from the patrons and seeing how appreciative they are for our help.”

In addition to serving their community, the students are also getting valuable experience that will help further their careers post-graduation.

“In my field, I’m going to school for, you need to build connections, build rapport in your community,” said Groome, who is also a research intern with the Bureau of Healthcare, Substance Use Disorder, and Mental Health Services. “You need to have those relationships with them, because I want to get into policy making. So I can see where policies actually make the biggest differences. So getting to meet people through this program is very important.”

Groome added that the VITA program helps her understand what her clients are looking for, what they need help with, and the real-world experiences they are hoping to achieve.

Ciara Quinn, a sophomore accounting major, also credited the program with giving her valuable experience.

“This class sounded like a great opportunity to gain experience while simultaneously earning course credit, volunteering my time, and getting to know the community surrounding UD,” she said. “I’m glad that I signed up because it has given me a better idea of what the ‘real-world’ of accounting will be like post-graduation, and it has given me a window into the potential of working in tax.”

McDougal, who set a goal of 50 participating students next year, said it’s more than helping students become good tax professionals, but also good individuals.

“Yes, we give them coursework and are trying to prepare them for a career, but you don’t just work,” she said. “Your life should have many facets, and one of those should involve giving back to the community in some way, shape or form.”

Contact Us

Have a UDaily story idea?

Contact us at ocm@udel.edu

Members of the press

Contact us at 302-831-NEWS or visit the Media Relations website